Huntington Ingalls Industries | ||||

Notice of Annual Meeting And Proxy Statement 2019 |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

(Amendment No. )

Filed by the Registrant ☒ Filed by a Party other than the Registrant ☐

Check the appropriate box:

| ☐ | Preliminary Proxy Statement |

| ☐ | Confidential, for Use of the Commission Only (as permitted by Rule14a-6(e)(2)) |

| ☒ | Definitive Proxy Statement |

| ☐ | Definitive Additional Materials |

| ☐ | Soliciting Material under Rule14a-12 |

HUNTINGTON INGALLS INDUSTRIES, INC.

(Name of registrant as specified in its charter)

(Name of person(s) filing proxy statement, if other than the registrant)

Payment of Filing Fee (Check the appropriate box):

| ☒ | No fee required. | |||

☐ | Fee computed on table below per Exchange Act Rules14a-6(i)(1) and0-11. | |||

| (1) | Title of each class of securities to which transaction applies: | |||

| ||||

| (2) | Aggregate number of securities to which transaction applies: | |||

| ||||

| (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): | |||

| ||||

| (4) | Proposed maximum aggregate value of transaction: | |||

| ||||

| (5) | Total fee paid:

| |||

| ☐ | Fee paid previously with preliminary materials. | |||

| ☐ | Check box if any part of the fee is offset as provided by Exchange Act Rule0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. | |||

| (1) | Amount Previously Paid: | |||

| ||||

| (2) | Form, Schedule or Registration Statement No.: | |||

| ||||

| (3) | Filing Party: | |||

| ||||

| (4) | Date Filed: | |||

| ||||

Huntington Ingalls Industries | ||||

Notice of Annual Meeting And Proxy Statement 2019 |

Letter to Our Stockholders

March 20, 201818, 2019

Dear Fellow Stockholders:

On behalf of the Board of Directors and management team of Huntington Ingalls Industries, I would like to invite you to attend the 20182019 Annual Meeting of Stockholders. We will meet on Wednesday, May 2, 2018,Tuesday, April 30, 2019, at 11:00 a.m. Eastern Daylight Time, at our corporate headquarters located at the Herbert H. Bateman Virginia Advanced Shipbuilding and Carrier Integration Center (VASCIC), 2401 West Avenue, Newport News, Virginia 23607. We are looking forward to your responses on the proposals included in the accompanying proxy statement.

The accompanying Notice of 20182019 Annual Meeting and Proxy Statement describe the matters on which you, as a stockholder, may vote at the annual meeting, and include details of the business to be conducted at the meeting.

As a way to conserve natural resources and reduce annual meeting costs, we are electronically distributing proxy materials as permitted under rules of the Securities and Exchange Commission. Many of you will receive a Notice of Internet Availability of Proxy Materials containing instructions on how to access the proxy materials via the Internet. You can also request mailed paper copies if preferred. You can expedite delivery and reduce our mailing expenses by confirming in advance your preference for electronic delivery of future proxy materials. For more information on how to take advantage of this cost-saving service, please see page 1314 of the proxy statement.

Your vote is very important. Whether or not you plan to attend the annual meeting, I encourage you to vote your shares in advance. Stockholders can submit their votes over the Internet at the web address included in the Notice of Internet Availability of Proxy Materials. If you received a proxy card, you can submit your votes over the Internet at the web address included in the proxy card, by telephone through the number included in the proxy card, or by signing and dating your proxy card and mailing it in the prepaid and addressed envelope.

Thank you for your support of Huntington Ingalls Industries. I look forward to seeing you at the annual meeting.

Sincerely,

ADMAdmiral Thomas B. Fargo

U.S. Navy (Ret.)

| Chairman |

|

Notice of 20182019 Annual Meeting of Stockholders

Huntington Ingalls Industries, Inc.

4101 Washington Avenue

Newport News, Virginia 23607

DATE AND TIME |

| |||

| PLACE | Herbert H. Bateman Virginia Advanced Shipbuilding and Carrier Integration Center (VASCIC), 2401 West Avenue, Newport News, Virginia 23607 | |||

| ITEMS OF BUSINESS | • | Elect | ||

| • | Approve the company’s executive compensation on an advisory basis | |||

| • | ||||

| Ratify the appointment of Deloitte & Touche LLP as our independent auditors for | ||||

| • | Consider a stockholder proposal to | |||

| • | Transact any other business that properly comes before the annual meeting | |||

| RECORD DATE

| Stockholders of record at the close of business on March | |||

| PROXY VOTING | It is important you vote your shares so they are counted at the annual meeting. You can vote your shares over the Internet at the web address included in the Notice of Internet Availability of Proxy Materials and included in the proxy card (if you received a proxy card), by telephone through the number included in the proxy card (if you received a proxy card), or by signing and dating your proxy card (if you received a proxy card) and mailing it in the prepaid and addressed envelope. | |||

Charles R. Monroe, Jr.

Corporate Vice President,

Associate General Counsel and Secretary

March 20, 201818, 2019

Important Notice Regarding the Availability of Proxy Materials for the Stockholder Meeting to Be Held on MayApril 30, 2019: 2, 2018: The Notice of 20182019 Annual Meeting and Proxy Statement and 20172018 Annual Report are available as of today’s date, March 20, 2018,18, 2019, at www.envisionreports.com/HII.

Proxy Statement—Table of Contents

| 1 | ||||

| General Information About the Annual Meeting and Voting | ||||

| 10 | ||||

| 12 | ||||

Item 2—Proposal to Approve Executive Compensation on an Advisory Basis | ||||

| ||||

Important Reminder of Effect of Not Casting Your Vote if You Are a Street Name Stockholder | 13 | |||

| 13 | ||||

| 15 | ||||

| 15 | ||||

| 15 | ||||

| 15 | ||||

| 17 | ||||

| 18 | ||||

| 19 | ||||

| 20 | ||||

| 20 | ||||

| 21 | ||||

| 23 | ||||

| 25 | ||||

| 27 | ||||

i

20182019 Proxy Statement Summary

This summary highlights information contained elsewhere in this proxy statement. This summary does not contain all the information you should consider, and you should read the entire proxy statement carefully before voting.

Annual Meeting Information

|

Date and Time: |

| |

Place: | Herbert H. Bateman Virginia Advanced Shipbuilding and Carrier Integration Center (VASCIC) 2401 West Avenue Newport News, Virginia 23607 | |

Record Date: | March | |

Voting: | Holders of our common stock are entitled to one vote per share | |

Admission: | To attend the meeting in person, you will need to follow the instructions included on page | |

Items to be Voted at the Annual Meeting

|

Board Vote Recommendation | Page Reference (for more information) | Board Vote Recommendation | Page Reference (for more information) | |||||||||

1.

|

Elect ten directors

|

FOR

|

82

| Elect 11 directors | FOR | 85 | ||||||

2.

|

Approve the company’s executive compensation on an advisory basis

|

FOR

|

83

| Approve the company’s executive compensation on an advisory basis | FOR | 86 | ||||||

3.

|

Select the frequency of future advisory approvals of executive compensation on an advisory basis

|

FOR ONE YEAR

|

84

| Ratify the appointment of our independent auditors | FOR | 87 | ||||||

4.

|

Ratify the appointment of our independent auditors

|

FOR

|

85

| Consider a stockholder proposal to permit an unlimited number of stockholders to aggregate their ownership of HII common stock to satisfy the ownership requirement under our proxy access bylaw, if properly presented at the meeting | AGAINST | 88 | ||||||

5.

|

Consider a stockholder proposal to enable stockholders to take action by written consent, if properly presented at the meeting

|

AGAINST

|

86

| |||||||||

20182019 Notice and Proxy Statement 1

20182019 Proxy Statement Summary

Corporate Governance Highlights |

Huntington Ingalls Industries, Inc. (“HII,” the “company,” “we,” “us” or “our”) is committed to high standards of corporate governance, which we believe promote the long-term interests of stockholders, strengthen accountability of the Board of Directors (the “Board”) and management and build public trust in the company. Highlights of our corporate governance practices include:

Board Structure and Governance | • | Diverse independent Board | ||

| • | All standing Board committees comprised of independent directors | |||

| • | ||||

| • | Independentnon-executive Chairman of the Board | |||

| • | ||||

| • | Director term limits | |||

| • | Mandatory director retirement age | |||

| • | Limits on outside public company board service by directors to prevent overboarding | |||

| • | Active stockholder outreach and engagement | |||

Stockholder Rights | • | Annual election of all directors | ||

| • | Director resignation policy if more votes are withheld than cast for any director | |||

| • | Ability of eligible stockholders to include their own director nominees in our proxy materials (proxy access) | |||

| • | Ability of stockholders to call a special meeting of stockholders | |||

| • | Annual advisory vote on named executive officer compensation | |||

| • | No stockholder rights plan (poison pill) | |||

Stock Ownership | • | |||

| • | Clawback policy for all performance-based compensation | |||

| • | Prohibition on directors and executives hedging or pledging our common stock |

Stockholder Engagement |

We believe that stockholder outreach and engagement is an essential element of strong corporate governance. Accordingly, we actively engage with our investors so that management and the Board can better understand stockholder perspectives on matters that are important to them, and to assess emerging issues that may help shape our practices and enhance our corporate disclosures. We strive for a collaborative approach to stockholder engagement and value the variety of stockholder perspectives we receive. Management and, in some cases, members of the Board actively engagesengage with our investors through telephonic meetings,in-person meetings and email to understand their perspectives on our company, including our strategy, performance, corporate governance matters and executive compensation. During 2017,2018, management requested meetings withcontacted the corporate governance teams of our largest institutional stockholders, and other interested stockholderscollectively representing approximately 42% of our outstanding shares, and met with those stockholders representing approximately 18% ofthat accepted our outstanding shares.meeting invitations. We are committed to understanding the perspectives of our stockholders and responding as appropriate.

2 Huntington Ingalls Industries, Inc.

20182019 Proxy Statement Summary

The following sections of this proxy statement summary describe the matters on which our stockholders will vote at the 20182019 annual meeting of stockholders.

ELECT |

Director Nominees

The Board is asking you to elect, forone-year terms ending in 2019,2020, the ten11 nominees for director named below, each of whom is currently serving as a member of the Board. The following table provides summary information about the nominees for director, including their names, ages and occupations, whether they are independent directors under the corporate governance listing standards of the New York Stock Exchange (“NYSE”), and the Board committees on which they currently serve. The directors will be elected by a plurality vote, but any director who receives a greater number of votes “withheld” from his or her election than votes “for” such election must tender to the Board his or her offer of resignation.

| ||||||||||||||

|

| |||||||||||||

|

| |||||||||||||

|

| |||||||||||||

|

| |||||||||||||

|

| |||||||||||||

|

| |||||||||||||

|

| |||||||||||||

|

| |||||||||||||

|

| |||||||||||||

|

| |||||||||||||

| ||||||||||||||

| Board Committees | ||||||||||||||||

Name | Age | Director Since | Principal Occupation | Independent Director | AC | CC | FC | GP | ||||||||

Philip M. Bilden | 54 | 2017 | Retired Senior Advisor andCo-Founding Member of HarbourVest Partners, LLC | ü | ü | ü | ||||||||||

Augustus L. Collins | 61 | 2016 | Chief Executive Officer of MINACT Incorporated | ü | ü | ü | ||||||||||

Kirkland H. Donald | 65 | 2017 | Independent Business Consultant | ü | ü | ü | ||||||||||

Thomas B. Fargo | 70 | 2011 | Chairman of the Board of Directors of Huntington Ingalls Industries, Inc. | ü | ü | |||||||||||

Victoria D. Harker | 54 | 2012 | Executive Officer and Chief Financial Officer of Tegna, Inc. | ü | C | ü | ||||||||||

Anastasia D. Kelly | 69 | 2011 | Managing Partner of DLA Piper Americas | ü | ü | C | ||||||||||

Tracy B. McKibben | 49 | 2018 | Founder and Chief Executive Officer of MAC Energy Advisors LLC | ü | ü | |||||||||||

C. Michael Petters | 59 | 2011 | President and Chief Executive Officer of Huntington Ingalls Industries, Inc. | |||||||||||||

Thomas C. Schievelbein | 65 | 2011 | Retired Chairman and Chief Executive Officer of The Brink’s Company | ü | ü | C | ||||||||||

John K. Welch | 69 | 2015 | Retired President and Chief Executive Officer of Centrus Energy Corp. | ü | ü | ü | ||||||||||

Stephen R. Wilson | 72 | 2015 | Independent Business Consultant and Retired Executive Vice President and Chief Financial Officer of RJR | ü | C | |||||||||||

AC = Chair

AC = Audit Committee

CCC = Compensation Committee

FFC = Finance Committee

GP = Governance and Policy Committee

20182019 Notice and Proxy Statement 3

20182019 Proxy Statement Summary

Board Composition Qualifications

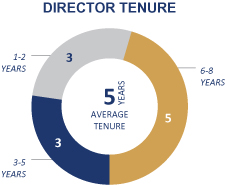

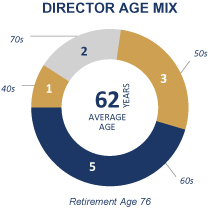

Our Board continues to reflect a diverse and Diversity

We believehighly engaged group of directors with a wide range of skills, experiences and perspectives, which continue to evolve. More than half of our directors have joined the Board is comprised of an effective mix of experience, skills and perspectives.in the last four years. The following charts and graphs highlight the current composition of our Board.Board:

|

| |

| ||

|  | |

Director Experience and Skills

4 Huntington Ingalls Industries, Inc.

VSenior Leadership Experience Finance, Accounting and Capital Markets Experience Industry Experience Manufacturing and Operations Experience Human Resources Experience Military and Government Experience Government Relations and Regulatory Experience Legal, Regulatory and Compliance Experience Technology Experience Risk Management Experience Corporate Development and Strategy Experience Global Experience

20182019 Proxy Statement Summary

Director Experience and Skills

SKILL/EXPERIENCE TOTAL OF 11 SENIOR LEADERSHIP EXPERIENCE Chief executive officer, president, chairman or similar leadership position in a large company or other large organization (for profit, not for profit, public or private) 10 FINANCE, ACCOUNTING AND CAPITAL MARKETS Experience in accounting or financial reporting, financing transactions or capital markets 7 INDUSTRY EXPERIENCE Experience in shipbuilding, other defense contractors, nuclear, oil and gas, other energy companies, construction, advanced technology or engineering 9 MANUFACTURING AND OPERATIONS Experience in complex, heavy manufacturing, engineering or logistics 8 HUMAN RESOURCES Broad experience in executive development, performance and compensation, or management of a large, unionized workforce 8 MILITARY AND GOVERNMENT EXPERIENCE Service in senior military positions or the government, including homeland security or intelligence 6 GOVERNMENT RELATIONS AND REGULATORY Expertise providing products or services to the U.S government and compliance with applicable regulations 8 LEGAL, REGULATORY AND COMPLIANCE Experience in legal and regulatory matters, and compliance with corporate compliance and ethics policies and corporate governance matters 11 PUBLIC COMPANY BOARDS Service on boards of other public companies or comparable organizations 8 TECHNOLOGY EXPERTISE Significant experience with technology, science and innovation 10 RISK MANAGEMENT Experience in risk management as an executive or risk oversight as a member of a board committee charged with this function 9 CORPORATE DEVELOPMENT AND STRATEGY Experience with developing and implementing strategies for growth, including acquisitions and joint ventures 9 GLOBAL EXPERIENCE Broad exposure to companies or organizations that have a significant global presence 8

The Board, through the Governance and Policy Committee, considers Board succession on a continuous basis. The committee’s process includes evaluation of director attributes, including professional experience, skills, diversity, independence, tenure and age, to create a balanced Board that can effectively oversee the company’s business and execution of its business strategy.

2019 Notice and Proxy Statement 5

2019 Proxy Statement Summary

APPROVE EXECUTIVE COMPENSATION ON AN ADVISORY BASIS |

The Board is asking you to approve, on an advisory basis, the compensation of our named executive officers for 2017.2018.

Our stockholders have voted on our executive compensation, on an advisory basis, since 2012. We2012, and we have consistently received exceptionally strong stockholder support, as reflected insupport. The following table sets forth the following table:voting results for our“say-on-pay” proposal for the last five years:

Annual Meeting

| 2017

| 2016

| 2015

| 2014

| 2013

| 2012

| 2018 | 2017 | 2016 | 2015 | 2014 | |||||||||||||||||||||||||||||||||

Votes Cast “FOR”Say-On-Pay Proposal

|

|

98

|

%

|

|

99

|

%

|

|

99

|

%

|

|

99

|

%

|

|

99

|

%

|

|

84

|

%

| 99 | % | 98 | % | 99 | % | 99 | % | 99 | % | ||||||||||||||||

Executive Compensation

We have designed our executive compensation program to attract, motivate and retain highly qualified executives, incentivize our executives to achieve business objectives, reward performance and align the interests of our executives with the interests of our stockholders and customers. The fundamental philosophy of our executive compensation program, set by the Compensation Committee of the Board, ispay-for-performance. We describe below our financial performance and stockholder returns in 2017.2018.

20172018 Financial Performance

StrongSolid operating performance in 20172018 delivered solid financial performance. The following table includes several of our 20172018 financial highlights:

|

| |

| ||

| ||

| ||

| ||

| ||

| ||

| ||

| ||

| ||

| ||

|

| 2018 Financial Highlights | ($ in millions, except per share data) | |||

Contract Awards | $ | 9,804 | ||

Revenues | 8,176 | |||

Operating Income | 951 | |||

Operating Margin | 11.6 | % | ||

Segment Operating Income* | 663 | |||

Net Earnings | 836 | |||

Diluted Earnings Per Share | 19.09 | |||

Cash from Operations | 914 | |||

Free Cash Flow* | 512 | |||

| * | Segment operating income and free cash flow |

Our full year revenues of $7.4$8.2 billion in 20172018 increased 5.3%9.9% over 2016.2017. Operating income was $865$951 million and operating margin was 11.6%, compared to $858$881 million and 12.1%11.8%, respectively, in 2016.2017. New contract awards in 20172018 totaled $8.1$9.8 billion, resulting in a backlog of $21.4$23.0 billion at the end of the year.

2018 Notice and Proxy Statement 5

2018 Proxy Statement Summary

2017 Stockholder Returns

Our operating performance continues to drive significant returns for our stockholders. AdjustedDiluted earnings per share was $19.09 in 2018, compared to $10.46 in 2017 and adjusted diluted earnings per share remained constant atshare* of $12.14 per share from 2016 toin 2017. We also increased dividends by 20%, from $2.10 per share in 2016 to $2.52 per share in 2017 to $3.02 per share in 2018, and repurchased 1.43.6 million shares during 2017,2018, continuing to deliver on our commitment to return cash to stockholders.

| * | Adjusted diluted earnings per share is anon-GAAP financial measure. See Annex A for definitions ofnon-GAAP financial measures and reconciliations to comparable GAAP financial measures. |

6 Huntington Ingalls Industries, Inc.

2019 Proxy Statement Summary

The following graph and chart show total stockholder return for HII in 20172018 compared to several benchmarks and total cash returned to stockholders in 2017,2018, respectively.

1-YEAR TOTAL STOCKHOLDER RETURN | CASH RETURNED STOCKHOLDERS IN | |

|

|

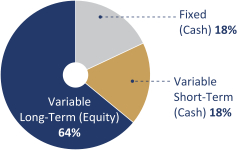

Elements of Our Executive Compensation Program

Our named executive officers (“NEOs”)compensation program for 2017 are our Chief Executive Officer, our Chief Financial Officer and our three other most highly-compensated executive officers in 2017 who were serving as executive officers at the end of the year and another individual who was one of2018 (collectively, our three other most highly-compensated executive officers in 2017 but was not serving as an executive officer at the end of the year. Our compensation program for our NEOs“NEOs”) consisted primarily of the following direct compensation elements in 2017:2018:

Base salary, to provide a minimum fixed level of compensation.

Annual incentive awards, generally paid in cash, under our Annual Incentive Plan (“AIP”), to motivate our executives to achievepre-determined annual financial and operational targets that are aligned with our strategic goals.

Long-term equity-based incentive awards, paid under our Long-Term Incentive Plan (“LTIP”), to promote achievement ofpre-determined three-year performance goals aligned with long-term stockholder interests.

Our executive compensation program is rounded out with certain perquisites and other executive benefits.

A significant portion of the potential compensation of our executives is at risk, and that risk increases with each executive’s level of responsibility. We have designed our compensation program to balance performance-based compensation over the short- and long-term to incentivize decisions and actions that promote stockholder value and focus our executives on performance that benefits our stockholders and customers, while discouraging inappropriate risk-taking behaviors.

6 2019 Notice and Proxy StatementHuntington Ingalls Industries, Inc. 7

*Includes $2 million subject to settlement as of December 31, 2017.

20182019 Proxy Statement Summary

20172018 Total Direct Compensation Mix

Thepay-for-performance philosophy of our executive compensation program is demonstrated by the compensation mix of our NEOs. Of the three primary elements of total direct compensation, our executive compensation is heavily weighted toward the variable, performance-based elements and toward the long-term and equity-based elements, as reflected in the following graphs,charts, which set forth the percentage of total compensation corresponding to each compensation element received by our CEO and by our other NEOs collectively in the aggregate in 2017.2018.

CEO Compensation Mix1

| Other

| |

|  |

| (1) | Our CEO elected to receive a base salary of $1; his fixed (cash) compensation therefore represented 0% of his total direct compensation. Total direct compensation does not include perquisites and other benefits. |

| (2) | Average allocation for the NEOs other than the CEO. Total direct compensation does not include perquisites and other benefits. |

Compensation Best Practices

We believe our compensation practices are aligned with and reinforce ourpay-for-performance philosophy and our related executive compensation principles.

What We Do

| ✓ | Consideration of annual stockholder“say-on-pay” advisory vote on executive compensation. |

| ✓ | Pay for performance compensation program heavily weighted toward variable, performance-based elements and toward long-term and equity-based elements. |

| ✓ | Annual assessment of potential risk posed by our compensation programs. |

| ✓ | Executive compensation “clawback” policy. |

| ✓ | Targeted external compensation benchmarking. |

| ✓ | Independent compensation consultant engaged by Compensation Committee. |

| ✓ | Executive stock ownership guidelines based upon multiple of executive’s base salary. |

| ✓ | Executive stock holding requirements, which require executives to holdone-half of their equity awards for three additional years after they vest. |

What We Don’t Do

| ✗ | No employment agreements for executives. |

| ✗ | Nochange-in-control agreements for executives or related executive taxgross-up benefits. |

| ✗ | Prohibitions against speculative transactions in our securities, pledging our securities as collateral and hedging transactions involving our securities. |

| ✗ | No dividends or dividend equivalents paid on restricted performance stock rights during performance period. |

2018 Notice and Proxy Statement8 7Huntington Ingalls Industries, Inc.

20182019 Proxy Statement Summary

|

The Board is asking you to select the frequency of your future advisory votes on the company’s executive compensation on an advisory basis. The Board is recommending a vote in favor of future advisory approvals of executive compensation every year.

RATIFY THE APPOINTMENT OF INDEPENDENT AUDITORS |

The Board is asking you to ratify the selection of Deloitte & Touche LLP as our independent auditors for 2018.2019. The following table contains summary information with respect to fees billed to us in 20172018 by Deloitte & Touche for professional services.

| ||||

Fees Billed: | ||||

Audit Fees | ||||

Audit-Related Fees | ||||

Tax Fees | ||||

All Other Fees | ||||

Total |

CONSIDER A STOCKHOLDER PROPOSAL TO STOCKHOLDERS TO THE OWNERSHIP REQUIREMENT UNDER OUR PROXY ACCESS BYLAW, IF PROPERLY PRESENTED AT THE MEETING |

You are being asked to consider a stockholder proposal requesting that the Board undertaketake the steps necessary to enable the company’spermit an unlimited number of stockholders to take action by written consentaggregate their ownership of HII common stock to satisfy the stockholders.ownership requirement under our proxy access bylaw. The Board is recommending a vote against this proposal.

8 2019 Notice and Proxy StatementHuntington Ingalls Industries, Inc. 9

General Information About the Annual Meeting and Voting

The Board is providing you with these proxy materials in connection with its solicitation of proxies to be voted at our 20182019 Annual Meeting of Stockholders and at any postponement or adjournment of the annual meeting. In this proxy statement, Huntington Ingalls Industries, Inc. may also be referred to as “we,” “our,” “us,” “HII” or “the company.”

ITEMS OF BUSINESS TO BE CONSIDERED AT THE ANNUAL MEETING

The Board is asking you to vote on the following items at the annual meeting:

elect ten11 directors;

approve the company’s executive compensation on an advisory basis;

consider a stockholder proposal to enablepermit an unlimited number of stockholders to take action by written consent,aggregate their ownership of HII common stock to satisfy the ownership requirement under our proxy access bylaw, if properly presented at the meeting.

The Board asks you to appoint Kellye L. Walker and Charles R. Monroe, Jr. as your proxy holders to vote your shares at the annual meeting. You make this appointment by submitting your proxy using one of the voting methods described below.

If appointed by you, the proxy holders will vote your shares as you direct on the matters described in this proxy statement. If you received a proxy card and you complete and return the proxy card but do not provide voting directions, they will vote your shares as recommended by the Board on all of the matters described in this proxy statement that are brought before the annual meeting.

The Board is not aware of any business that may properly be brought before the annual meeting other than those matters described in this proxy statement. If any other matters are properly brought before the annual meeting, your proxy gives discretionary authority to the proxy holders to vote the shares in their best judgment.

NOTICE OF INTERNET AVAILABILITY OF PROXY MATERIALS

Pursuant to rules adopted by the Securities and Exchange Commission (“SEC”), we are permitted to furnish our proxy materials to our stockholders over the Internet by delivering a Notice of Internet Availability of Proxy Materials. The Notice of Internet Availability of Proxy Materials instructs you on how to access and review the proxy statement and 20172018 Annual Report over the Internet. The Notice of Internet Availability of Proxy Materials also instructs you on how you may submit your proxy over the Internet. We believe thise-proxy process expedites receipt of proxy materials by stockholders, while also lowering our costs and reducing the environmental impact of our annual meeting. We have used thise-proxy process to furnish proxy materials to certain of our stockholders over the Internet.

If you received a Notice of Internet Availability of Proxy Materials in the mail and would like to receive a printed copy of our proxy materials, you should follow the instructions for requesting these materials provided in the Notice of Internet Availability of Proxy Materials.

2018 Notice and Proxy Statement 9

General Information About the Annual Meeting and Voting

Stockholders owning our common stock at the close of business on March 8, 2018,6, 2019, the record date, or their legal proxy holders, are entitled to vote at the annual meeting. The Board strongly encourages

10 Huntington Ingalls Industries, Inc.

General Information About the Annual Meeting and Voting

you to vote. Your vote is important. Voting early helps ensure we receive a quorum of shares necessary to hold the annual meeting. Many stockholders do not vote, meaning the stockholders who do vote influence the outcome of the matters on which they vote in greater proportion than their percentage ownership of HII shares.

We have two types of stockholders: stockholders of record and “street name” stockholders. Stockholders of record are stockholders who own their shares in their own names on the company’s books. Street name stockholders are stockholders who own their shares through a bank, broker or other holder of record.

Voting by Stockholders of Record. If you are a stockholder of record, you have four voting options. You may vote:

| • | over the Internet atwww.envisionreports.com/HII, the web address included in the Notice of Internet Availability of Proxy Materials and in the proxy card (if you received a proxy card); |

by telephone through the number included in the proxy card (if you received a proxy card);

by signing and dating your proxy card (if you received a proxy card) and mailing it in the prepaid and addressed envelope; or

by attending the annual meeting and voting in person.

If you have Internet access, we encourage you to vote over the Internet. It is convenient, and it saves us significant postage and processing costs. In addition, when you vote by proxy over the Internet or by telephone prior to the meeting date, your proxy vote is recorded immediately and there is no risk that postal delays will cause your proxy vote to arrive late and therefore not be counted.

Internet and telephone voting facilities for stockholders of record are available 24 hours a day and will close at 11:59 p.m. Eastern Daylight Time on Tuesday, May 1, 2018.Monday, April 29, 2019. The Internet and telephone voting procedures verify you are a stockholder of record by use of a control number and enable you to confirm your voting instructions have been properly recorded. If you vote by Internet or telephone, you do not need to return your proxy card (if you received a proxy card).

Whether or not you plan to attend the annual meeting and vote in person, we urge you to have your proxy vote recorded in advance of the meeting. If you attend the annual meeting and vote at the annual meeting, any prior proxy votes you submitted, whether by Internet, telephone or mail, will be superseded by the vote you cast at the annual meeting. Because it is not practical for most stockholders to attend the annual meeting, the Board recommends you vote using one of the other voting methods. In any event, the method by which you vote your proxy will not limit your right to vote at the annual meeting if you decide to attend in person.

Revoking Your Proxy for Stockholders of Record. If you are a stockholder of record and you vote by proxy using any method, you may later revoke your proxy and change your vote at any time before the polls close at the annual meeting. You may do this by:

sending a written statement to that effect to Huntington Ingalls Industries, Inc., Attn: Corporate Secretary, 4101 Washington Avenue, Newport News, Virginia 23607, provided we receive your written statement before the annual meeting date; or

10 Huntington Ingalls Industries, Inc.

General Information About the Annual Meeting and Voting

signing and returning another proxy card with a later date, provided we receive the later proxy card before the annual meeting date; or

voting in person at the annual meeting.

2019 Notice and Proxy Statement 11

General Information About the Annual Meeting and Voting

Only the most recent proxy vote will be counted, and all others will be discarded regardless of the method of voting.

Voting by Street Name Stockholders. If your shares are held in “street name” through a broker, bank or other nominee, please refer to the instructions they provide regarding how to vote your shares or to revoke your voting instructions. The availability of telephone and Internet voting depends upon the voting processes of the broker, bank or other nominee. If you are a street name stockholder and would like to vote in person at the annual meeting, you must obtain a proxy, executed in your favor, from the bank, broker or other holder of record through which you hold your shares. Because it is not practical for most stockholders to attend the annual meeting, the Board recommends you vote using one of the other voting methods. In any event, the method by which you vote your proxy will not limit your right to vote at the annual meeting if you decide to attend in person.

Confidential Voting. We treat your vote as confidential to protect the privacy of our stockholders’ votes. Proxies and voting instructions provided to banks, brokers and other holders of record are kept confidential. Only the proxy solicitor, the proxy tabulator and the inspector of elections have access to the proxies and voting instructions.

QUORUM, VOTE REQUIRED AND METHOD OF COUNTING

At the close of business on the record date, 44,767,11941,656,877 shares of our common stock were outstanding and entitled to vote at the annual meeting. Each outstanding share is entitled to one vote.

A quorum must be present to transact business at the annual meeting. A quorum will be present if a majority of the outstanding shares entitled to vote as of the record date are present, in person or by proxy. If you indicate an abstention as your voting preference on all matters, your shares will be counted toward a quorum but will not be voted on any matter. If you are a street name stockholder and do not vote your shares, your bank, broker or other holder of record may vote your shares on the proposal to ratify the appointment of our independent auditors, which is known as a routine matter. Votes by a bank, broker or other holder of record on any routine matter will count for purposes of determining a quorum. In the absence of a quorum, the chairperson of the meeting may adjourn the meeting, and, at any reconvened meeting following such an adjournment at which a quorum is present, any business may be transacted whichthat might have been transacted at the original meeting.meeting may be transacted.

If you are a street name stockholder and do not vote your shares, your bank, broker or other holder of record can vote your shares in its discretion only on Item 43 described in this proxy statement. If you do not give your bank, broker or other holder of record instructions on how to vote your shares on Items 1, 2 3 and 54 described in this proxy statement, your shares will not be voted on those matters.

If you have shares in an employee benefit plan and do not vote those shares, your trustee will vote your shares in accordance with the terms of the relevant plan. Accordingly, your trustee may vote your shares in the same proportion as shares held by the plan for which voting instructions have been received, unless contrary to ERISA.

2018 Notice and Proxy Statement 11

General Information About the Annual Meeting and Voting

The required vote and method of calculation for the matters to be considered at the annual meeting are as follows:

Item 1—Proposal to Elect Directors

Directors will be elected by a plurality of the shares present in person or by proxy at the annual meeting or any adjournment thereof and entitled to vote on the election of directors. Plurality voting means the ten11 director nominees receiving the most votes will be elected to the Board. If you do not want your shares to be voted with respect to a particular director nominee, you may “withhold” your vote with respect to that nominee. If a director nominee receives a greater number of votes “withheld”

12 Huntington Ingalls Industries, Inc.

General Information About the Annual Meeting and Voting

for his or her election than votes cast “for” his or her election, such nominee will be required under the majority vote director resignation policy included in our Corporate Governance Guidelines to submit an offer of resignation to the Board for its consideration. If you are a street name stockholder and do not vote your shares, your bank, broker or other holder of record cannot vote your shares on this item, and brokernon-votes will have no effect on the outcome of the vote.

Item 2—Proposal to Approve Executive Compensation on an Advisory Basis

The executive compensation of our NEOs will be approved as an advisory recommendation to the Board if the number of shares voted in favor exceeds the number of shares voted against. Abstentions will have no effect on the results of the vote. If you are a street name stockholder and do not vote your shares, your bank, broker or other holder of record cannot vote your shares on this item, and brokernon-votes will have no effect on the outcome of the vote. Although the vote on this item isnon-binding, the Compensation Committee will review the results of the vote and consider it in making future decisions concerning executive compensation.

Item 3—Proposal to Select Frequency of Future Advisory Approvals of Executive Compensation on an Advisory Basis

The frequency of future stockholder advisory approvals (every year, every two years, or every three years) receiving the greatest number of votes will be considered the frequency recommended by stockholders. Abstentions will have no effect on the results of the vote. If you are a street name stockholder and do not vote your shares, your bank, broker or other holder of record cannot vote your shares on this item, and brokernon-votes will have no effect on the outcome of the vote. Although the vote on this item isnon-binding, the Board will review the results of the vote and consider the vote in adopting a policy concerning the frequency of such advisory votes in the future.

Item 4—Proposal to Ratify Appointment of Our Independent Auditors

Ratification of appointment of our independent auditors will be approved if the number of shares voted in favor exceeds the number of shares voted against. Abstentions will have no effect on the results of the vote. If you are a street name stockholder and do not vote your shares, your bank, broker or other holder of record can vote your shares at its discretion on this item.

Item 5—4—Stockholder Proposal to EnablePermit an Unlimited Number of Stockholders to Take Action by Written ConsentAggregate Their Ownership of HII Common Stock to Satisfy the Ownership Requirement Under Our Proxy Access Bylaw

The stockholder proposal to enablepermit an unlimited number of stockholders to take action by written consentaggregate their ownership of HII common stock to satisfy the ownership requirement under our proxy access bylaw will be approved if the number of shares voted in favor exceeds the number of shares voted against the proposal. Abstentions will have no effect on the results of the vote. If you are a street name stockholder and do not vote your shares, your bank, broker or other holder of record cannot vote your shares on this item, and brokernon-votes will have no effect on the outcome of the vote.

12 Huntington Ingalls Industries, Inc.

General Information About the Annual Meeting and Voting

IMPORTANT REMINDER OF EFFECT OF NOT CASTING YOUR VOTE IF YOU ARE A STREET NAME STOCKHOLDER

If you are a street name stockholder, it is critical you vote your shares if you want your vote to count on Items 1, 2 3 and 5.4. Your bank, broker or other holder of record is not permitted to vote your shares on Items 1, 2 3 or 5,4, unless you instruct them how you wish to vote. Such “brokernon-votes” will have no impact on the results of the vote on Items 1, 2 3 or 5.4.

SOLICITING AND TABULATING VOTES

The Board has made these materials available to you in connection with its solicitation of proxies for use at our annual meeting. We will bear the costs of soliciting and tabulating your votes. Our employees, personally, by telephone, by email or otherwise, may solicit your votes without additional compensation. In addition, we have retained MacKenzie Partners, Inc. to assist in the solicitation of proxies for the 20182019 annual meeting for a fee of $12,500,$15,000, plus associated costs and expenses.

We will reimburse banks, brokers and other holders of record for reasonable,out-of-pocket expenses for forwarding these proxy materials to you, according to certain regulatory fee schedules. See “Electronic Access to Proxy Statement and Annual Report” below for information on how you can help reduce printing and mailing costs.

2019 Notice and Proxy Statement 13

General Information About the Annual Meeting and Voting

ELECTRONIC ACCESS TO PROXY STATEMENT AND ANNUAL REPORT

You can elect in advance to receive future proxy materials by email. If you choose to receive future proxy materials by email, you will receive an email with instructions containing a link to the website where those materials are available, as well as a link to the proxy voting website.

If you are a stockholder of record, you may enroll in the electronic delivery service by going directly to www.envisionreports.com/HII. You may revoke your electronic delivery election at this site at any time and request a paper copy of the proxy statement and annual report.

If you are a street name stockholder, you may also have the opportunity to receive copies of the proxy statement and annual report electronically. Please check the information provided in the proxy materials you received from your bank, broker or other holder of record concerning the availability of this service.

We have adopted a procedure called “householding.” Under this procedure, stockholders of record who have the same address and last name and do not participate in electronic delivery of proxy materials will receive only one copy of the Notice of Internet Availability of Proxy Materials or the printed proxy materials, unless we have received contrary instructions from one or both such stockholders. This procedure reduces our printing costs and postage fees and is environmentally friendly.

If you and another stockholder of record with whom you share an address are receiving multiple copies of the Notice of Internet Availability of Proxy Materials or the printed proxy materials, you can request to receive a single copy of the printed proxy materials in the future by calling our transfer agent, Computershare, at1-888-665-9610, or writing to us at Investor Relations, 4101 Washington Avenue, Newport News, VA 23607. If you and another stockholder of record with whom you share an address wish to receive a separate Notice of Internet Availability of Proxy Materials or separate printed proxy materials, we will promptly deliver them to you if you request them by contacting Computershare by phone or Investor Relations in writing in the same manner as described above.

2018 Notice and Proxy Statement 13

General Information About the Annual Meeting and Voting

Stockholders who participate in householding and who receive printed proxy materials will continue to receive separate proxy cards. If you are a street name stockholder, you can request householding by contacting your bank, broker or other holder of record through which you hold your shares.

14 Huntington Ingalls Industries, Inc.

OVERVIEW OF CORPORATE GOVERNANCE

Corporate governance addresses the relationships among the Board, company management and the company’s stockholders, with the objectives of promoting the company’s long-term success, improving corporate performance, strengthening Board and management accountability and promoting the long-term interests of our stockholders. The Board and senior management are committed to high standards of corporate governance. We believe those high standards are important not only to our stockholders, but also to our customers, employees, suppliers and other stakeholders.

The following sections provide an overview of our corporate governance model and practices. Among other topics, we describe the responsibilities of the Board, how directors are selected and certain key aspects of Board operations.

RESPONSIBILITIES OF THE BOARD OF DIRECTORS

We believe the foundation for good corporate governance starts with a board of directors whose independence, skills, experience and judgment will enable the board to effectively oversee management of the company and to provide constructive advice and counsel to management. The Board and its committees perform a number of important functions for the company and its stockholders, including:

overseeing and providing advice on and overseeing the company’s strategic plan developed by management;

assessing the significant enterprise risks to which the company is subject and overseeing management of those enterprise risks;

selecting our chief executive officer and evaluating the performance of the chief executive officer and other senior executive officers;

overseeing development and succession plans for our senior executives;executive officers;

monitoring the company’s financial performance and reviewingevaluating and approving significant corporate actions;

overseeing processes that protect the integrity of the company, including the integrity of the company’s financial statements and compliance with legal requirements and the company’s ethics and business conduct standards; and

evaluating the effectiveness of the Board and its committees.

The Board’s oversight role is also effected through the Board’s four standing committees—the Audit Committee, the Compensation Committee, the Governance and Policy Committee and the Finance Committee. Each of these committees operates under a separate written charter to promote clarity in their responsibilities and to ensure the committees function in coordination with each other and with the full Board. Our committees are discussed in greater detail beginning on page 21 of this proxy statement.

The Board believes all director candidates must possess certain basicfundamental qualifications and that specialized skills and experiences should be contributed to the Board by individual directors. The

20182019 Notice and Proxy Statement 15

Board and the Governance and Policy Committee consider the qualifications of directors and director candidates individually and in the broader context of the Board’s collective skills and experiences measured against the current and future needs of the Board.

Qualifications for All Directors. The Board believes all its members must possess the following basicfundamental qualifications:

high personal and professional integrity and ethical standards;

substantial educational, business, military or professional accomplishments in leading organizations;

ability to represent the best interests of all stockholders; and

demonstrated leadership ability and sound judgment.

Prospective directors must also be willing to submit to a background check necessary for obtaining a security clearance.

Selection of Individual Candidates. In addition to the qualifications applicable to all director candidates, the Board and the Governance and Policy Committee consider, among other matters, a candidate’s knowledge of and experience in such areas as:

senior leadership

finance, accounting and capital markets

the industries in which the company competes

manufacturing and operations

human resources

military and government

government relations and regulatory

legal, regulatory and compliance matters

public company boards

technology

risk management

corporate development and strategy

global operations

We also consider whether a candidate can commit sufficient time and attention to Board activities and any potential conflicts with the company’s interests. Our objective is to have the collective skills, experiences and perspectives that create an outstanding, dynamic and effective Board and strengthen the Board’s ability to oversee the company’s business, enhance its performance and represent the long-term interests of stockholders. All of ournon-employee directors are expected to serve on Board committees, supporting the Board’s mission by providing expertise to those committees, and the needs of those committees are considered when evaluating director candidates. The Board and the Governance and Policy Committee also consider diversity factors when selecting director nominees, seeking representation of a range of experiences, backgrounds and perspectives.

16 Huntington Ingalls Industries, Inc.

Governance of the Company

Service on Other Boards. In accordance with our Corporate Governance Guidelines, the Board considers the number of boards of other public companies and audit committees of those boards on which a director candidate serves. Under our Corporate Governance Guidelines, directors should not

16 Huntington Ingalls Industries, Inc.

serve on more than four boards of publicly-traded companies in addition to our Board, and our directors who also serve as chief executive officers or in equivalent positions of other companies should not serve on more than two other boards of publicly-traded companies, in each case without the approval of the chairman of our Governance and Policy Committee. A director who is a full-time employee of our company may not serve on the board of directors of more than two other publicly-traded companies, unless approved by the Board. No member of our Audit Committee may serve on the audit committees of more than three publicly-traded companies (including our company) without the approval of the Board, which must determine annually that such simultaneous service would not impair the ability of the member to effectively serve on our Audit Committee.

Retirement Policy. Under the retirement policy of our Corporate Governance Guidelines, a director will not bere-nominated at the annual meeting following the earlier of his or her 76th birthday or 15 years of service on the Board. Upon the recommendation of the Governance and Policy Committee, the Board may waive either of these requirements as to any director, if the Board deems waiver to be in the best interests of the company. In addition to our retirement policy, when a director’s principal occupation or business association changes substantially during his or her tenure as a director, the Board expects the affected director willto tender his or her resignation for consideration by the Governance and Policy Committee and the Board, as provided in our Corporate Governance Guidelines.

Conclusion. Satisfaction of the foregoing criteria for Board membership is implemented and assessed through continuous consideration of director succession by the Governance and Policy Committee and the Board, as well as through the Board’s self-evaluation process. The Board and the Governance and Policy Committee believe that, individually and collectively, the company’s current directors possess the necessary qualifications to provide effective oversight of the company’s business and contribute constructive advice and counsel to the company’s management.

The Governance and Policy Committee is responsible under its charter for recommending to the full Board director nominees for election by our stockholders and for identifying and recommending candidates to fill any vacancies that may occur on the Board. The Governance and Policy Committee may use a variety of sources to identify candidates. Candidates may be identified through recommendations from independent directors or members of management, search firms, discussions with other persons who may know of suitable candidates to serve on the Board and stockholder recommendations.

Evaluations of director candidates who would be new to the Board (other than nominees recommended by our stockholders, as described below) include consideration of the candidate’s background and qualifications by the Governance and Policy Committee, interviews with the Chairman of the Board, members of the Governance and Policy Committee and one or more other Board members who desire to interview a candidate, and deliberations of the Governance and Policy Committee and the full Board. The Governance and Policy Committee then recommends the candidate(s) to the full Board, with the full Board selecting the candidate(s) to be nominated for election by our stockholders or to be elected by the Board to fill a vacancy.

In connection with its recommendations to the Board of director nominees for election at each annual meeting, the Governance and Policy Committee considers the size of the Board and the criteria set forth above to recommend nominees who, individually and as a group and collectively with directors who will continue to serve on the Board, the Governance and Policy Committee believes satisfy the

2019 Notice and Proxy Statement 17

Governance of the Company

qualifications the Board needs. Accordingly, the Governance and Policy Committee annually reviews the composition of the Board as a whole and makes recommendations, if necessary, to improve the Board to achieve what it believes is the optimal mix of experience, expertise, skills, specialized knowledge, diversity and other factors.

2018 Notice and Proxy Statement 17

Stockholders who wish to recommend director candidates for consideration by the Governance and Policy Committee must submit the name and relevant information about the candidate in writing to the Corporate Secretary. All director candidates recommended by stockholders are required to meet the criteria for directors described above, and candidates who meet the criteria described above will be evaluated by the Governance and Policy Committee. In accordance with our Corporate Governance Guidelines, the Governance and Policy Committee will evaluate director candidates recommended by stockholders in the same manner as candidates identified through other means.

Stockholders who wish to nominate a person for election as a director at an annual meeting must follow the procedures set forth in our bylaws and described beginning on page 2627 of this proxy statement. Additionally, our bylaws include a proxy access right, which enables a stockholder or a group of up to 20 stockholders owning continuously for at least three years an amount of shares that constitutes 3% or more of our outstanding common stock as of the date of nomination to nominate and include in our proxy materials director candidates constituting up to the greater of 25% of the number of directors then in office or two directors, subject to the requirements specified in our bylaws. Stockholders who wish to nominate director candidates for inclusion in our proxy materials under our proxy access bylaw provisions must satisfy the requirements in our bylaws, as described under the heading “Communications and Company Documents—Future Stockholder Proposals and Nominations of Directors” of this proxy statement. The Board expects to evaluate any director candidates nominated through the proxy access process in a manner similar to that for other director candidates.

MAJORITY VOTE DIRECTOR RESIGNATION POLICY

Our Corporate Governance Guidelines include a majority vote director resignation policy. Under such policy, any nominee for director who receives a greater number of votes “withheld” from his or her election than votes “for” such election (a “Majority Withhold Vote”) in an uncontested election of directors must tender to the Board his or her offer of resignation within five days following certification of the stockholder vote. The Governance and Policy Committee will promptly consider the resignation offer and make a recommendation to the Board to accept or reject the tendered offer of resignation. The Board will act on the Governance and Policy Committee’s recommendation within 90 days following certification of the stockholder vote. The Board will then promptly disclose its decision to accept or reject the director’s resignation offer, including its rationale, in a report furnished to or filed with the SEC.

The Governance and Policy Committee in making its recommendation, and the Board in making its decision, will consider the best interests of the company and our stockholders and may consider any other factors or other information that it considers appropriate and relevant, including but not limited to:

the stated reasons, if any, why stockholders withheld their votes;

possible alternatives for curing the underlying cause of the withheld votes;

the director’s tenure;

the director’s qualifications;

the director’s past and expected future contributions to the company; and

18 Huntington Ingalls Industries, Inc.

Governance of the Company

the overall composition of the Board and its committees, including whether, if the offer of resignation is accepted, the company will no longer be in compliance with any applicable law, rule, regulation or governing document.

Any director who tenders his or her offer of resignation under our majority vote director resignation policy will not participate in the Governance and Policy Committee deliberation or recommendation or

18 Huntington Ingalls Industries, Inc.

Board deliberation or action to accept or reject the resignation offer. If a majority of the Governance and Policy Committee received a Majority Withhold Vote at the same election, then the independent directors (other than those who received a Majority Withhold Vote in that election) will instead appoint a committee among themselves to consider the resignation offers and recommend to the Board whether to accept them. If, however, the independent directors who did not receive a Majority Withhold Vote constitute two or fewer directors, all independent directors may participate in the action to accept or reject the resignation offers, except that each director who has tendered his or her offer of resignation will recuse himself or herself from the deliberations and voting with respect to his or her individual offer to resign.

If a director’s resignation offer is not accepted by the Board, that director will continue to serve for the term for which he or she was elected and until his or her successor is duly elected, or his or her earlier resignation or removal. If a director’s resignation offer is accepted by the Board, then the Board, in its sole discretion in accordance with our bylaws, may fill any resulting vacancy or may decrease the size of the Board.

STOCKHOLDERS RIGHT TO NOMINATE PROXY ACCESS NOMINEES

Our bylaws provide our stockholders proxy access rights. Under Section 2.15 of our bylaws, we are required to include in our proxy materials for an annual meeting any stockholder nominee who is nominated by an “Eligible Stockholder.” An “Eligible Stockholder” is any stockholder or group of up to 20 stockholders that has beneficially owned continuously for at least three years an amount of shares that constitutes 3% or more of our outstanding common stock as of the date of nomination. Eligible Stockholders must provide proof of ownership of the requisite amount of stock for the three-year time period and represent that the shares were acquired in the ordinary course of business and not to change or influence control of the company. Eligible Stockholders must also provide certain other written representations, warranties and agreements to the company, including an agreement to assume liability from any legal or regulatory violation arising out of the Eligible Stockholder’s communication with our stockholders and to comply with all applicable laws and regulations, as described in more detail in Section 2.15 of the bylaws.

The maximum number of directors who can be nominated by Eligible Stockholders, referred to as “Stockholder Nominees,” at any annual meeting is the greater of 25% of the number of directors then in office or two directors. Section 2.15 of our bylaws includes procedures to prioritize nominations if the number of Stockholder Nominees exceeds the maximum number of Stockholder Nominees we are required to include in our proxy materials for any annual meeting. Stockholder Nominees must provide written notice to the company, which must include specific information, including information similar to the information required from stockholders to propose business and director nominations through the advance notice provisions included in Section 2.08 of our bylaws. As described in Section 2.15 of our bylaws, this notice must include an express consent to be named as a director nominee in our proxy materials and to serve as a director if elected, as well as required disclosures and information about, and representations, undertakings and consents by, the Stockholder Nominee to enable the Board to determine whether the Stockholder Nominee meets the independence and other general requirements for directors set forth in our bylaws and corporate governance guidelines.our Corporate Governance Guidelines.

Stockholders who would like to nominate candidates using proxy access should refer to Section 2.15 of our bylaws, which sets forth all the requirements for proxy access nominations. The Board may

2019 Notice and Proxy Statement 19

Governance of the Company

exclude any Stockholder Nominee from our proxy materials if the Stockholder Nominee or Eligible Stockholder(s) fail to meet the requirements or provide the undertakings set forth in our bylaws or corporate governance guidelinesCorporate Governance Guidelines and for other reasons set forth in our bylaws. See “Communications and Company Documents—Future Stockholder Proposals and Nominations of Directors.”

2018 Notice and Proxy Statement 19

The Board makes determinations regarding the independence of our directors on an annual basis, based upon the Governance and Policy Committee’s evaluation of director independence and related recommendations to the Board. Under our Corporate Governance Guidelines, to be considered independent: (i) a director must be independent as determined under Section 303(A).02(b) of the NYSE Listed Company Manual and (ii) in the Board’s judgment, the director must not have a material relationship with the company (either directly or as a partner, shareholder or officer of an organization that has a relationship with the company).

The Board has considered relevant relationships between the company and eachnon-employee director to determine compliance with NYSE independence requirements. Based upon its review, the Board has determined that Mr. Bilden, Gen.General Collins, ADMAdmiral Donald, ADMAdmiral Fargo, Ms. Harker, Ms. Kelly, Ms. McKibben, Mr. Schievelbein, Mr. Welch and Mr. Wilson, who comprise the Board’snon-employee directors, are independent. The Board has also determined that each current member of the Audit Committee satisfies the additional independence requirements of the SEC and that each current member of the Compensation Committee satisfies the enhanced independence requirements of the NYSE listing standards.

The Board also considered in 2017 relevant relationships between the company and ADM Paul D. Miller, who retired from the Board effective May 3, 2017. Based upon its review, the Board determined that ADM Miller was independent for purposes of serving on the Board and that ADM Miller satisfied the additional independence requirements for Compensation Committee members.

The Board understands that one of its primary responsibilities is to evaluate and determine the optimal leadership structure for the Board from time to time to facilitate effective oversight of the company. Our bylaws establish the position of Chairman, and our Corporate Governance Guidelines state that the Board believes it is in the best interests of the company and its stockholders for the Board to have the flexibility to determine the best director to serve as Chairman. The independent directors consider this matter on at least an annual basis. This consideration includes the advantages and disadvantages of a combined chairman and chief executive officer role and separate chairman and chief executive officer roles in the context of our operating and governance environment over time, with the goal of achieving the optimal model for the Board’s effective oversight of the company’s affairs.

Non-Executive Chairman. The Board has considered the Board leadership matter and determined an independent,non-executive chairman is the optimal model for the company at this time. This structure provides the Board with independent leadership and allows the chief executive officer to focus on the company’s business operations. The independent directors appointed ADMAdmiral Fargo as ournon-executive Chairman of the Board at the time the company was spun offbegan operating as an independent stand-alone company in 2011, and he has served as Chairman since that time.

Ournon-executive Chairman has the following responsibilities under our Corporate Governance Guidelines:

chair all Board and stockholder meetings, including executive sessions of the independent directors;

serve as a liaison between the chief executive officer and the independent directors;

ensure the quality, quantity and timeliness of the flow of information from management to the Board; although management is responsible for the preparation of materials for the Board, thenon-executive Chairman may specifically request the inclusion of certain materials;

20 Huntington Ingalls Industries, Inc.

prepare the agendas of the Board meetings and assist the chairman of each standing committee with preparation of agendas for the respective committee meetings, taking into account the requests of other Board and committee members;

set an appropriate schedule for Board meetings to assure there is sufficient time for discussion of all agenda items;

along with the chairman of the Governance and Policy Committee, interview all Board candidates and make recommendations to the Governance and Policy Committee and the Board;

have the authority to call meetings of the Board and meetings of the independent directors; and

if requested by the chief executive officer, be available for consultation and direct communication with stockholders.

Conclusion. All of our directors play an active role in overseeing the company’s business at both the Board and committee levels. The Board is currently comprised of onenon-independent director who serves as our Chief Executive Officer and nineten independent directors. Our independent directors are skilled and experienced leaders in industry and the military. Our independent directors are effective in collaborating with management and thoroughly considering proposals made by management, and an independent Board leader supportsfacilitates this relationship. We therefore believe anon-executive Chairman of the Board, along with eightnine other strong independent directors, is an appropriate and effective structure at this time to oversee the company’s affairs and to provide advice and counsel to the Chief Executive Officer and other seniorexecutive management of the company.

BOARD COMMITTEE FUNCTIONS AND MEMBERSHIP

The Board has four standing committees: Audit, Compensation, Governance and Policy and Finance. Each of the Audit, Compensation and Governance and Policy Committees is constituted and operated in accordance with SEC requirements and the NYSE’s corporate governance listing standards; the Finance CompanyCommittee is not subject to any such requirements or standards. Each Board committee is governed by a written charter, which sets forth the responsibilities of the committee, including the responsibilities described in this section. Each charter can be viewed on our website at www.huntingtoningalls.com and is available in print to any stockholder requesting a copy. All members of each Board committee are independent, as determined under the corporate governance listing standards of the NYSE.

Audit Committee. The Audit Committee’s responsibilities includeinclude:

Overseeing HII’s relationship with its independent auditor, including (i) reviewing andpre-approving each service and related fees considered to be auditing services andnon-prohibitednon-audit services and (ii) meeting periodicallywith the independent auditor to review, among other things, all critical accounting policies, all material alternative accounting treatments discussed with management, and all material written communications with each ofmanagement

Overseeing our independent auditorinternal audit function

Overseeing financial statement and our Vice President of Internal Audit to review audit resultsdisclosure matters, including meeting with management, the internal auditors and the adequacy of and compliance with our system of internal controls. In addition, the Audit Committee appoints and discharges our independent auditor, evaluates proposed audit and permissiblenon-audit services from the independent auditor for their impact onto review and discuss the independencecontent of our periodic reports, including financial information, and management’s assessment of internal control over financial reporting

Overseeing other matters, including our major financial risk exposures and our compliance program.

2019 Notice and Proxy Statement 21

Governance of the auditor and, if appropriate, approves such services.Company

The members of the Audit Committee are Mr. Wilson (chair), Gen.General Collins, Mr. Schievelbein and Mr. Welch. The Board has determined, in accordance with NYSE requirements, that each member of the Audit Committee is financially literate and that Mr. Wilson possesses accounting or related financial management expertise. The Board has also determined that Mr. Wilson qualifies as an “audit committee financial expert,” as defined under applicable SEC rules.

Compensation Committee. The Compensation Committee overseesCommittee’s responsibilities include:

Establishing annual and long-term performance goals and objectives for the Chief Executive Officer and all other elected officers, and evaluating those officers against their goals and objectives

Reviewing, approving and submitting for ratification by the independent members of the Board the Chief Executive Officer’s compensation

Reviewing and approving the direct and indirect compensation of all other elected officers

Reviewing and benefit programs and makes compensation decisions that affect our elected officers. The Compensation Committee also provides strategic direction for our overall compensation structure, policies and programs and reviews senior management succession plans. The Compensation Committee considers and makes recommendationsrecommending to the Board matters concerning compensation of Board members

Reviewing the succession of qualified executive management

Identifying, in consultation with management, the appropriate peer group for competitive comparisons and relative position of pay levels versus peers

Overseeing our policy regarding the recovery of performance-based short- or long-term cash or equity incentive compensation of directors.

2018 Notice and Proxy Statement 21payments in certain circumstances.

The members of the Compensation Committee are Ms. Harker (chair), Mr. Bilden, ADMAdmiral Donald and Ms. Kelly. Ms. Kelly and Mr. Bilden were appointed to the Compensation Committee in May 2017 and November 2017, respectively. The Board has determined that each member of the Compensation Committee qualifies as anon-employee director under SEC Rule16b-3 and as an outside director for purposes of Section 162(m) (“Section 162(m)”) of the Internal Revenue Code of 1986 (“IRC”). None of our executive officers served as a member of the board of directors or compensation committee of any entity that has one or more executive officers serving as a member of our Board or our Compensation Committee. Accordingly, no interlocks with other companies, within the meaning of the SEC’s proxy rules, existed during 2017.2018.

Governance and Policy Committee. The Governance and Policy Committee is responsible for developingCommittee’s responsibilities include:

Developing and recommending to the Board criteria for Board membership; identifying,membership

Identifying and reviewing the qualifications of director candidates; and assessingcandidates

Assessing the contributions and independence of incumbent directors in determining whether to recommend them for reelection to the Board. The GovernanceBoard

Identifying and Policy Committee also considersrecommending committee member appointments to the Board

Reviewing stockholder proposals and makesrecommending any Board response

Considering and making recommendations to the Board regarding transactions with related persons and corporate governance matters generally and oversees

Overseeing the evaluation of the Board. Board

Generally monitoring the Board’s oversight of risk management.

22 Huntington Ingalls Industries, Inc.

Governance of the Company

The members of the Governance and Policy Committee are Ms. Kelly (chair), Gen.General Collins, ADMAdmiral Fargo and Mr. Welch.

Finance Committee. The Finance Committee overseesCommittee’s responsibilities include:

Overseeing and reviewsreviewing our financial affairs, strategies and policies. The Finance Committee is responsible for reviewingpolicies

Reviewing and making recommendations to the Board regarding:

our financial policies and strategies, capital structure and financial condition

our issuances of debt and equity securities and significant borrowing transactions

strategic transactions

employee benefit plan assets

our dividend policy and stock repurchase programs and

significant capital expenditures. The Finance Committee also providesexpenditures

Providing oversight to ensure that our financial policies and strategies are consistent with our capital budget, annual operating plan and strategic plan.

The members of the Finance Committee are Mr. Schievelbein (chair), Mr. Bilden, ADMAdmiral Donald, Ms. Harker and Ms. Harker. Mr. BildenMcKibben. Ms. McKibben was appointed to the Finance Committee in November 2017.December 2018.

We amended our certificate of incorporation in 2015 to phasephased out the classification of the Board, beginning with our annual meeting held in 2016 and ending with our annual meeting held in 2018. With thephase-out of the Board classification complete,Accordingly, all ten11 of our directors will be voted upon at our 20182019 annual meeting to serveone-year terms.

EXECUTIVE SESSIONS OFNON-EMPLOYEE DIRECTORS